Resumen

1 . Introduction: a reasonably positive economic juncture despite a bad international environment

Most analysts expect that this differential with the eu to remain over 2024 .

Moreover, public expenditure

Other indicators of economic activity are less encouraging behaviour and point to a progressive weakening of the economy if they are not corrected certain trends. The investment is at levels significantly lower than prior to the pandemic, a situation that, if sustained, inevitably lead to a loss of competitiveness.

2 . Why? Exports are growing and public expenditure

1 , which has been of 2 , 4 %. This dynamism was not what analysts – public and private – or by the government anticipated.

Figure 1 shows that developments in the spanish economy since the pandemic is the result of a quite different behaviour of the various components of demand. Private consumption in 2023 barely prepandemia level – reaching only a 0 , 1 per cent above –. Investment (FBCF) has fallen by 3 , 7 per cent below the levels prepandemia. In the opposite direction, the public consumption, go beyond a 11 the level of per cent 2019 , well above what is observed in the main european economies – the eurozone average is 6 , 8 % – adelantábamos. As previously, this has been one of the main drivers of growth of the spanish economy. Finally, exports have grown strongly, a 2 , 1 % well above imports.

Source: own compilation based on Eurostat data.

Source: own compilation based on Eurostat data.

If you look in total public expenditure, instead of public consumption, the image is similar. Public spending is situated at historical highs in both absolute level as a proportion of gdp. 2020 - 2021 public spending was extraordinarily high to respond to the situation also extraordinary, generated by the pandemic. 2022 - 2023 , the economy was returned to normal but the level of public spending remained at 2023 estimates provided by idescat, a 27 % (an 25 per cent in per capita terms) over 2019 just before the crisis. To gauge the importance of fiscal stimulus is Useful To the following reference: gdp growth in the closure of 2023 , 2 , 5 %, eight tenths are attributable to the public consumption.

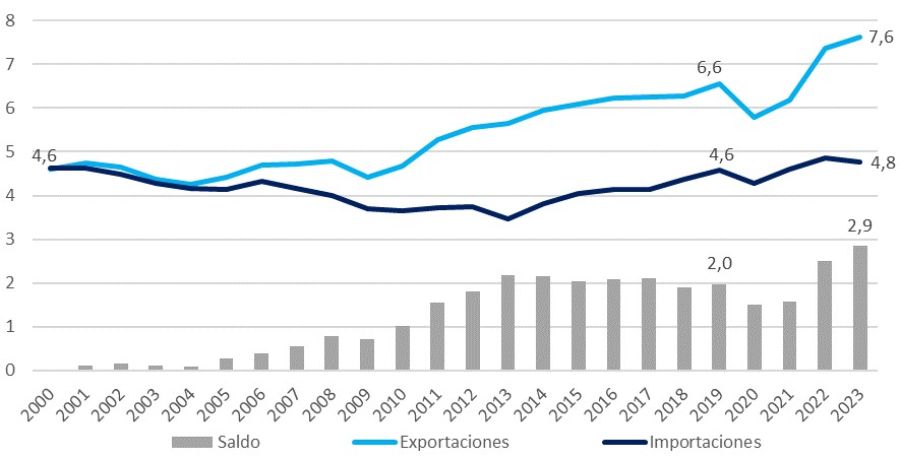

The external sector

The other factor that supports the recent growth has been the strong progress in exports, supported on tourism and sales of tourist services. The latter includes very heterogeneous sectors ranging from transport to financial services. The balance of these exchanges, which were null and void in the year 2000 a continued upward trend to 2 , 9 % of gdp in 2023 (see figure 2 ).

Source: own compilation based on INE data.

Source: own compilation based on INE data.

Labour market

2 in the sense that there is still a lot of room for harnessing innovation in products and processes to increase productivity

1 Unless otherwise indicated, all references to the eurozone in this article are without include ireland.

2 “ economic growth and social perception ”, Raymond Torres, the country, 11 february 2024

3. El futuro: Inversión y productividad

The decline in investment from 2020 it is a threat to the future competitiveness of our businesses. Without investment (and innovation), the only alternative to compete is by reducing costs, particularly the wages. It is necessary to an environment conducive to investment and To achieve this. it is particularly important to reduce the uncertainty about the future economic and fiscal framework, avoiding drastic policy changes that endanger investment by companies. Another key is the improvement of administrative and regulatory environment and avoid fragmentation, a point that the vast majority of actors, analysts and the government itself, a high priority.

Finally, european funds Next Generation, for his considerable volume and also on its capacity of private investment, should boost investment. The disbursement of funds NG by Brussels has been undertaken in line with the timetable – and in advance of the majority of the countries of our environment – but its deployment in the production apparatus has been slow, so that the potential still be tapped.

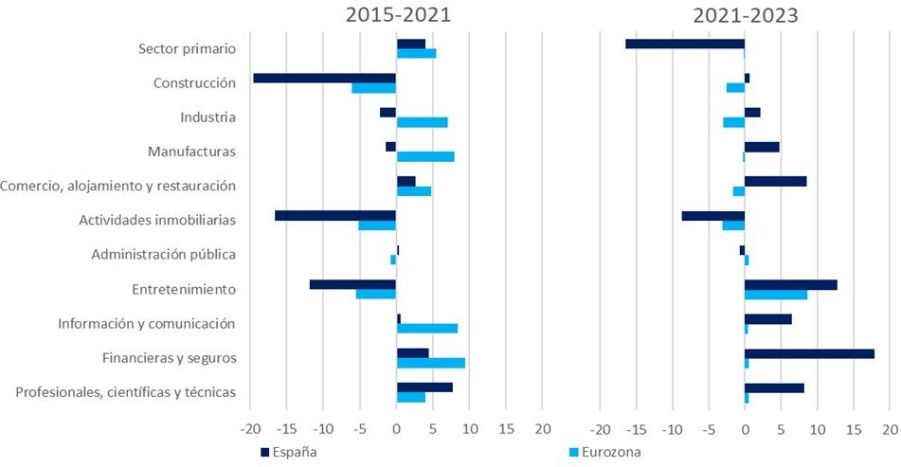

The problem of low productivity growth is not new. 2015 up 2021 overall productivity per hour worked in the spanish economy grew by 0 , 5 % compared to 3 , 7 per cent in the average for the eurozone, with a worse behaviour of this variable in nearly all sectors.In the past two years, the spanish productivity shows better performance than the rate in the eurozone, but this seems to have a strong cyclical,as it is due to the exceptional growth of spanish exports of services and the progress of the spanish economy much more intensively than the european countries (see figure 3 ).

Source: own compilation based on Eurostat data

Source: own compilation based on Eurostat data

The other key determinant of productivity is investment in human capital. To maintain the productive system requires that the training and education of the population is commensurate with what the different sectors and branches of economy requires to carry out its activity. It is clear that improving human capital is a long-term task that requires a good diagnosis of departure and synchronized action between administrations, educational institutions and companies.

In 2010 Spain had a labour force participation rate in university studies slightly above average of the eurozone, but had a greater difference was in the workforce with training and lower secondary education. This situation, twelve years later, has improved, but it still does not solve the problem. On the one hand, has been reduced by more than 10 points persons working with training to the lower secondary education, but this group continues to be clearly above the average for the eurozone (see figure 4 ).

Source: own compilation based on Eurostat data.

Source: own compilation based on Eurostat data.

3

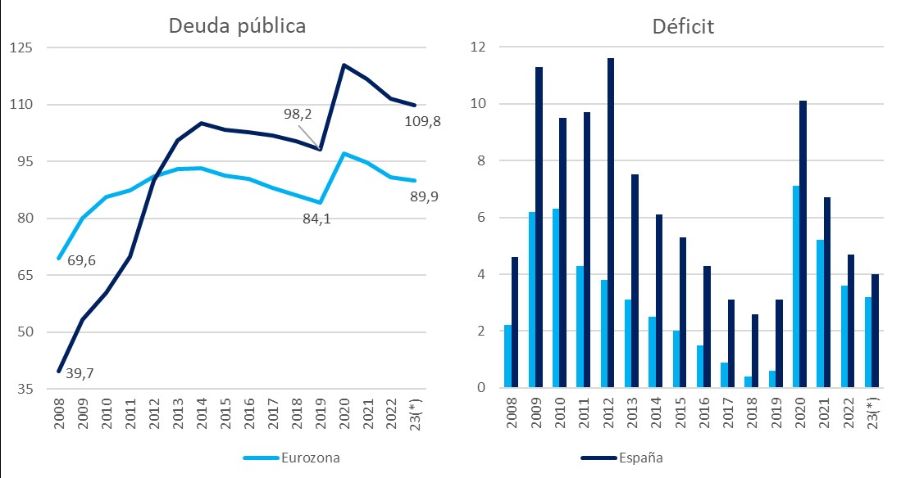

(*) Para la deuda, datos hasta el tercer trimestre. Para el déficit, previsión para el año completo. Fuente: Eurostat. Funcas (previsión España) y C. Europea (previsión UEM).

(*) Para la deuda, datos hasta el tercer trimestre. Para el déficit, previsión para el año completo. Fuente: Eurostat. Funcas (previsión España) y C. Europea (previsión UEM).

3

4. Conclusiones